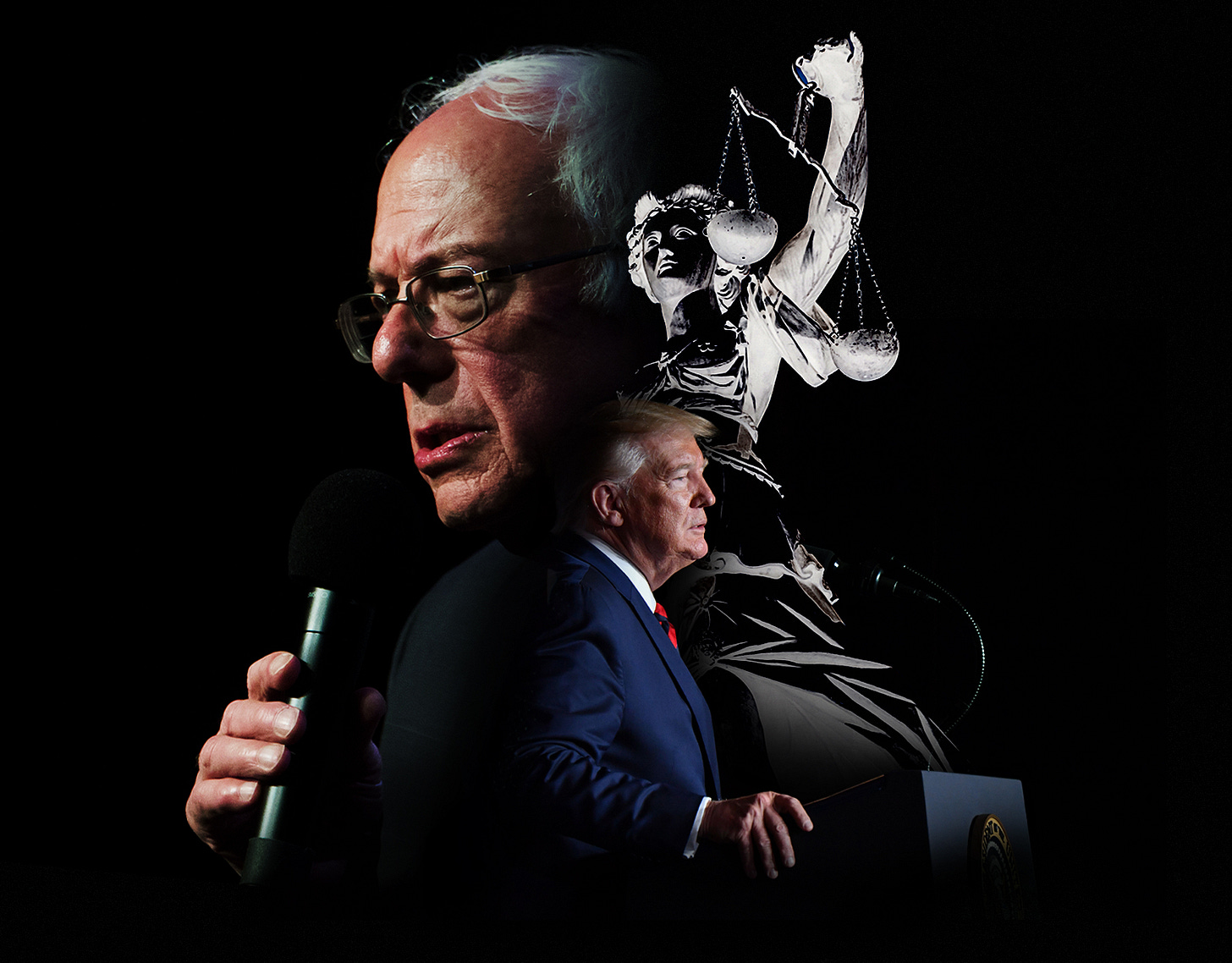

1. Viral Politics

Consider: A number of states will vote today in the Democratic primary. Now imagine the chaos we would be facing if this contest was not already functionally over. America owes Democratic primary voters a debt of gratitude, not just for rejecting socialism, but for doing it expeditiously. Because if, today, Joe Biden and Bernie Sanders were tied—or if Sanders was ahead and clinging to a lead as the states became more favorable to Biden—then the level of uncertainty and political chaos in this country would be an order of magnitude larger. As things stand now, we are facing a national crisis. Eight months from now we will have a choice between reelecting Donald Trump, or electing Joe Biden. Both of them are known commodities. Both are highly representative of their respective parties. The coming months of this crisis will only serve to highlight the contrast between the two men and their parties. But if Biden had still been locked in struggle with Sanders, then the actual character of the Democratic party would still be in flux. And—worse—there would be no way to resolve the intra-party conflict. Because the pandemic is going to interfere with voting to such a degree that whenever the contest was settled, neither candidate would have been seen as legitimate by the other's supporters. At which point the choice in November would have been muddled and unclear.

2. Reading List

(1) What we lost when the government dropped the ball on testing. Bloomberg gives a rundown of how the administration squandered the only advantage we had going into this crisis—time—by not moving full-speed ahead on testing supplies while the virus bloomed in China. “This is such a rapidly moving infection that losing a few days is bad, and losing a couple of weeks is terrible,” Jha said. “Losing 2 months is close to disastrous, and that’s what we did.” (2) Trump's administration was warned. The government has contingency plans for everything. Everything. For the fall of the Berlin Wall, for a Soviet first strike, for the emergence of MUTOs. These plans might not be good. They might be bare-bones or outdated. But the point of the plans isn't to have a cheat-sheet ready the minute a crisis strikes. The point is to have people already exposed to the idea of the crisis so that, when it hits, they're not starting from zero. New presidents are briefed on many of these plans. And as an incoming president, Donald Trump's team was briefed on the possibility of a world-wide pandemic:

POLITICO obtained documents from the meeting and spoke with more than a dozen attendees to help provide the most detailed reconstruction of the closed-door session yet. It was perhaps the most concrete and visible transition exercise that dealt with the possibility of pandemics, and top officials from both sides — whether they wanted to be there or not — were forced to confront a whole-of-government response to a crisis. The Trump team was told it could face specific challenges, such as shortages of ventilators, anti-viral drugs and other medical essentials, and that having a coordinated, unified national response was “paramount” . . .

Asked whether information about the pandemic exercise reached the president-elect, a former senior Trump administration official who attended the meeting couldn’t say for sure but noted that it wasn’t “the kind of thing that really interested the president very much.”

“He was never interested in things that might happen. He’s totally focused on the stock market, the economy and always bashing his predecessor and giving him no credit,” the person said. “The possibility things were things he didn’t spend much time on or show much interest in.

“Even though we would put time on the schedule for things like that, if they happened at all, they would be very, very brief,” the former official continued. “To get the president to be focused on something like this would be quite hard.”Anything associated with Obama or his administration was also a no-go zone for Trump aides. If you brought them up, “that would be an immediate rejection, like, ‘Why are they even here? Why the fuck did you ask them?’”

(3) People don't trust Trump. One of the things I've hammered over and over for the last three years is that Trump's total dislocation from facts, logic, and consistency were assets for him in many ways, because it made him unpredictable. The problem is that while "predictability" is a liability in many games based on negotiation or competition, it becomes an invaluable asset in games based on cooperation. Example: If you are negotiating a trade war with China, being unpredictable can give you an advantage over the Chinese, who can never be totally certain how you will react to a given move, and thus may be willing to forfeit some marginal advantages. Counter-example: If you are trying to stop a pandemic, being unpredictable will make it more difficult to rally public behavior, spread necessary information, and coordinate action across various public and private sector teams—because the general will not believe what you say and people in government down the delegation chain will not know what you want them to do. We are now at the point where Trump has squandered his public trust in such a way that only 42 percent of the public trusts Trump on the COVID-19 crisis. This lack of trust is likely to cost lives.

3. The Warby-Parker of X

Sometimes economic destruction is terrible and tragic. But sometimes it's delicious:

Even if you don’t know who Ty Haney is, if you’ve spent any time on Instagram you probably know her company by osmosis. Outdoor Voices, with its millennial branding and muted pastel athleisure-wear, is social-media bait. Searching the company’s hashtag, #DoingThings, surfaces images of young women, including Haney, breezily baring their midriffs while walking their dogs, hiking, or doing yoga, dressed in Outdoor Voices’ color-blocked leggings, skorts, and sports bras.

Haney, who co-founded the company in 2012 at the age of 24, found herself in charge of what appeared to be a rocket ship. Within four years, she raised $64 million in venture funding for her direct-to-consumer (DTC) startup, a then-newish breed of e-commerce company created in the image of Warby Parker—aiming to design a better version of an everyday product, selling it directly to consumers at a lower price, thereby retaining tight control over marketing, customer service, and a data feedback loop that would eventually enable it to usurp market share from legacy competitors. In Haney’s case, those competitors would be giants like Nike and Lululemon. She managed to woo J.Crew retail legend Mickey Drexler to be chairman of her board, and when she relocated Outdoor Voices from New York to Austin in 2017, she quickly became the face of the city’s hot, emerging startup scene, landing on the cover of Inc. magazine and the subject of a 10,000-word New Yorker profile. By all accounts, everything seemed perfect.

Until a few weeks ago, when a very different picture emerged of Outdoor Voices. The Business of Fashion reported that for all of the startup’s apparent growth and cachet — including 11 stores in cities like Los Angeles and Nashville — the company “continues to lose money on customer acquisition.” According to BoF, Outdoor Voices was hemorrhaging up to $2 million per month last year on annual sales of around $40 million. Its executives also seemed to be bailing out on a company in a tailspin. The new president Haney had managed to lure last year from Nike lasted only a few months, and Drexler left the board. The startup was able to get a new cash infusion from the company’s investors, but at a lower valuation than previous rounds. On February 25, CEO Haney sent a Slack message to her hundreds of employees: “with heartbreak, I have tendered my resignation,” BuzzFeed News reported. In the wake of her departure, she wrote, there would also be layoffs, and Cliff Moskowitz, the president of a fashion-oriented private-equity firm, would take over as interim CEO. . . . Even before the Outdoor Voices revelation, the past few months have exposed major cracks in the DTC business model, as several high-profile, venture-backed DTC startups have struggled and others have completely closed their doors. The investors bankrolling these companies are discovering one thing in common — that most of their money is going to expensive and ever-rising customer acquisition costs (CAC) via Google, Facebook, and Instagram. As one DTC investor has put it starkly before: “CAC is the new rent.” And even after these startups get on the treadmill of paying digital rent, they are then finding themselves also paying actual rent. After all, the most effective billboard is an outdoor L.A. luxury mall or an expensive SoHo storefront, which can cost some $60,000 a month. . . . When Casper filed its S-1 in January, analysts, investors, and business nerds descended on the document like vultures. Not only was it a precarious moment to take a startup public, it was the first time anyone could actually access the raw numbers under the hood of a DTC. “The economics work better if Casper sent you a mattress for free, stuffed with $300,” jabbed NYU Stern marketing professor and tech doomsayer Scott Galloway. “This appears to be Casper’s business,” tweeted number-crunching Atlantic columnist Derek Thompson. “Buy mattress at $400. Sell at $1,000. Refund/return 20% of them. Keep $400, on avg. Then spend $290 of that on ads/marketing and $270 on admin (finance, HR, IT). Lose $160. Repeat.”