Nixon and Carter Made Releasing Tax Returns a Norm. Then Along Came Trump.

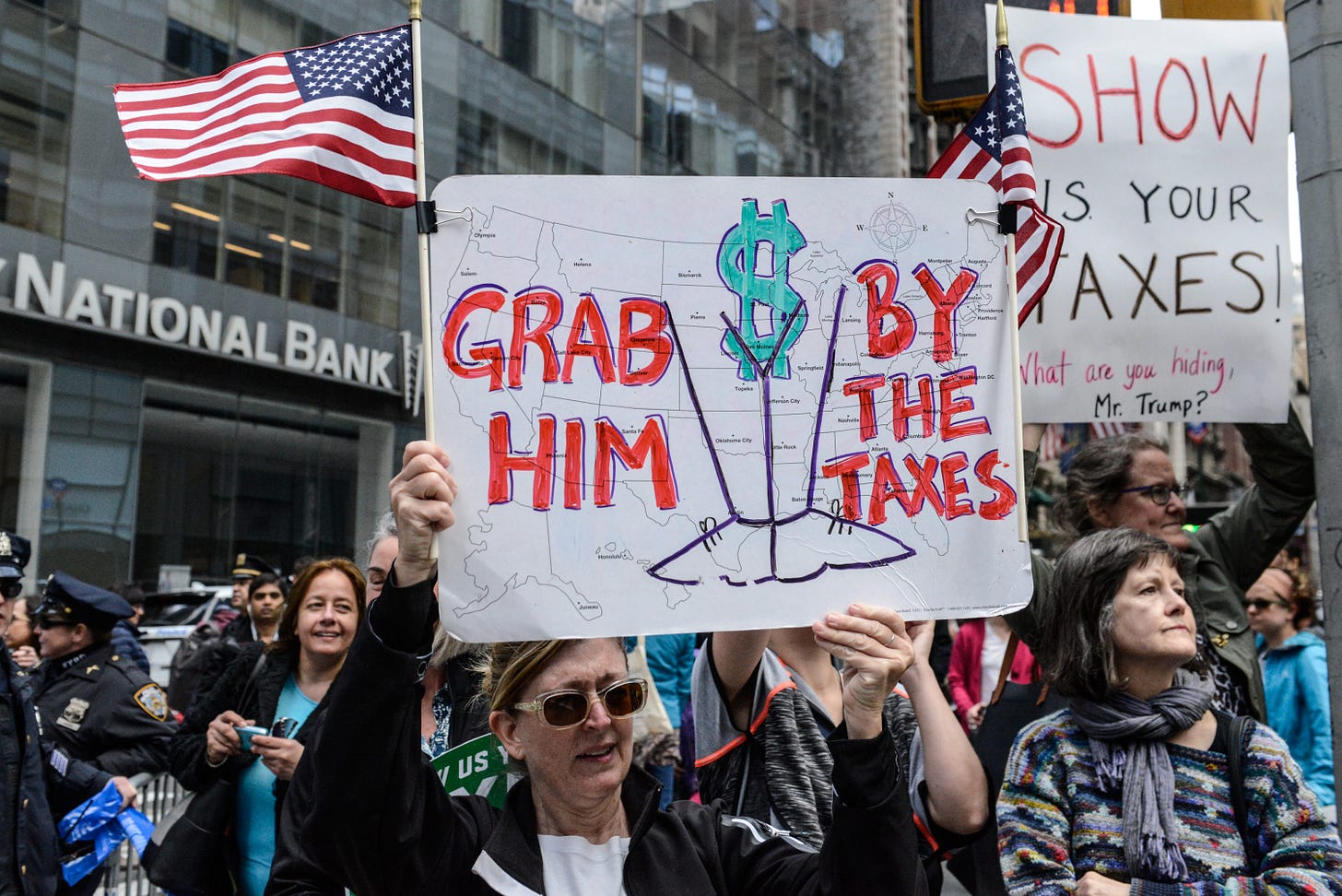

The president is going to the mat to keep his records from the public.

The messy slapfight over the release of Trump’s tax returns was delayed again this week after Treasury Secretary Steven Mnuchin ignored a congressional subpoena deadline to produce them Tuesday, claiming that the government needed another two weeks to assess the legality of the House Ways and Means Committee’s request. Meanwhile, Trump and his businesses filed suit against House Oversight and Reform Committee Chairman Elijah Cummings, complaining that “the Democrat Party … has declared all-out political war against President Donald J. Trump.”

Political war or no, the battle being waged by Trump, his Justice Department, his Treasury Department, and his businesses (and what a remarkable coalition that is!) will likely prove futile. The relevant law, obscure and little-used though it is, is cut-and-dry: The chairman of the House Ways and Means Committee can request any citizen’s tax returns, and the Treasury has to fork it over. Is it a bad law, overly broad, and prone to abuse? You bet! At the moment, however, it is the law.

At any rate, the relevant parties will slug it out in court in the weeks to come. In the meantime, it’s worth bearing in mind just how unusual the whole situation is. Trump has been the first president since Lyndon B. Johnson half a century ago to refuse to release even a synopsis of his tax returns publicly, a custom we’d come to think of as a no-brainer piece of executive accountability. Here’s a brief look back at how that custom came to be, and how presidents have treated it since.

Getting the Ball Rolling

The whole happy tradition first got started thanks to the actions of another famously ethical POTUS: Richard Nixon. It’s frequently forgotten now—thanks, Watergate!—but as that scandal gained steam in the early ’70s, Nixon was simultaneously trying to fight off accusations that he had grossly underpaid his personal income taxes for years. Nixon had been dogged by such rumors for months when, in October 1973, a disgruntled IRS staffer leaked his 1970 and ’71 returns to the Providence Journal-Bulletin, which demonstrated that, um, Nixon had grossly underpaid his personal income taxes for years.

Hoping to blunt the impact of the scandal, Nixon responded by voluntarily releasing several more years of returns, saying he wanted to reassure “the confidence of the American people in the integrity of the president.” (“I am not a crook” hails from here, too.) Somewhat counterproductively, there ended up being problems with these returns as well, and the government ultimately determined Nixon needed to fork over nearly $500,000 in back taxes.

Did Nixon’s eleventh-hour transparency play help him at all? It’s hard to say, as he resigned under threat of impeachment over Watergate less than a year later. But it did make the American people turn to one another and say, “Hey, these presidents—maybe we ought to know what’s going on in their finances!”

Setting the Precedent

That isn’t to say the fad caught on immediately. Gerald Ford, who became president when Nixon resigned, never released a full return—although he did opt to make public a decade’s worth of summary data for the years between 1966 and 1975. During the 1976 campaign, his opponent Jimmy Carter didn’t provide his returns either, giving Ford the transparency edge. However, America deemed his pardon for Nixon a more crucial issue and voted out the man who had never been voted in. Once Carter became president, he began to release his returns annually, a tradition that persisted until nearly the present day.

Making it Political

Happily, the transparency precedent for politicos' finances had been set. Unhappily, the politicos themselves soon got their mitts on it. Sensing that transparency and accountability were things voters craved in their elected officials, some politicians got the bright idea that, by releasing more returns than their opponents’, they could create an opportunity to ding them for unaccountability—a good old “what are they trying to hide?” routine. This in turn caused tax return releases to become not only an issue of presidential transparency, but a perennial part of presidential campaigning. This began as early as 1980, when George H. W. Bush successfully pressured Reagan to release his returns during that year’s Republican primary by releasing his first. (Nice move, but it didn’t work—Reagan wrapped up the nom later that year.)

Perhaps no candidate made more skillful use of tax return releases than Barack Obama, who managed to trip up a wealthier opponent in back-to-back elections. During his upset primary win of 2008, he released nearly a decade of returns dating back to 2000, which helped to highlight the contrast between him and his scandal-prone rival Hillary Clinton. Then, during the 2012 election, it was millionaire Mitt Romney’s turn to struggle over tax questions: Democrats made hay of the fact that Romney had released only a year of tax records. “If Mitt Romney’s not hiding something in Bermuda, and Switzerland, and the Caymans, it’ll be in the tax returns,” Obama adviser Robert Gibbs said then. These issues played into the impression many had that Romney was an out-of-touch 1 percenter, and helped Obama lock up his re-election.

The Trump Effect

We all know what happened next, of course: Donald Trump came along, took one look at a system everyone had assumed was settled, and announced it wasn't for him. Then, to the consternation of many, that announcement didn’t seem to hurt him in the slightest. Some of the president’s fans might argue this was a good thing—just a renegade president clearing away a useless and stodgy old tradition. After all, weren’t the fights over Romney’s tax returns tiresome political posturing—and can’t you make the argument that the fight over Trump’s is the same?

With a look back a little further, however, the lesson becomes plain. There are good reasons why politicians have decided they owe it to the voters to release this kind of data—even politicians who, unlike certain presidents, haven’t amassed fortunes through decades of allegedly dodgy tycoonery. Only time will tell if Trump’s nonchalant refusal to release his financial records is just a regrettable blip, or the beginning of a new and unfortunate trend.