For Italy’s Sake, Put the Central Bankers in Charge

The coronavirus crisis has made clear that the European Central Bank and not the German Constitutional Court should set European monetary policy.

Today, barely ten years after the European sovereign debt crisis roiled world financial markets, Europe is in the midst of its worst recession since the Great Depression. Once again, the future of the Euro is threatened. Surviving the crisis may require a quantum leap towards full European economic integration.

In 2010, in the wake of the Great Recession, the Eurozone experienced a sovereign debt crisis as markets came to question whether countries in the Eurozone’s periphery – namely Greece, Ireland, Italy, Portugal, and Spain – could continue to service their large public debt burdens. That in turn raised serious questions as to whether or not the Euro could survive.

In the event, the Euro did survive and the Eurozone economy eventually did recover, albeit gradually, with substantial support from the IMF, the European Central Bank (ECB), and the European Commission to the countries in the Eurozone’s beleaguered economic periphery. Its success was particularly the result of then-ECB President Mario Draghi’s July 2012 commitment to have the ECB do whatever it took to save the Euro.

With hindsight, it is difficult to overstate how fortunate Europe was to have an ECB so well equipped and so well led. Such a fortunate alignment of means, individuals, and ends was by no means guaranteed.

Today, largely as a result of the coronavirus epidemic, the Eurozone is again in the grips of a major recession. This recession is officially forecast to be the Eurozone’s worst since the Great Depression and will be significantly worse than that expected in the United States. The grim outlook is undermining the public finances of the countries in the Eurozone periphery, which did not take advantage of the good times to put their public finances on a sustainable path.

The case of Italy is of particular concern to the world economic outlook both because of the very size of the Italian economy and because of the unsustainable trajectory of its public finances.

Italy is the Eurozone’s third-largest member country by GDP. Official estimates project that in 2020, Italy’s economy is likely to decline by more than 10 percent and its budget deficit is likely to swell to more than 10 percent of GDP. That in turn will cause the Italian public-debt-to-GDP ratio to skyrocket to more than 160 percent by end 2020. That frightening prospect is already raising serious questions in the markets about the country’s ability to service its debt.

In principle, if the markets lose faith in Italy, it could be bailed out by the ECB. However, it is likely that this would be more difficult now than was the case with Greece in 2010. In part this is because an Italian bailout could cost at least $ 2 trillion – almost seven times as much as the $300 billion bailout of Greece in 2010.

But money is not the only obstacle. Thanks to a recent ruling by the German Constitutional Court, which questioned the legality of the ECB’s earlier large-scale bond buying program, the ECB may no longer be able to do whatever it takes to bail out as large a country as Italy. The German court is threatening to restrain the German Bundesbank from participating in any future ECB bailout program unless it is satisfied that the ECB is not engaging in the monetary financing of a member country’s government.

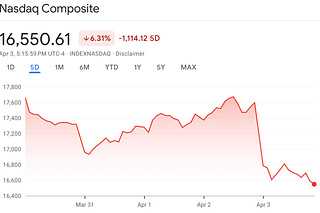

Any heightened doubts about Italy’s ability to service its debt are likely to unsettle world financial markets. This is, in part, because with its government debt totaling more than $2.5 trillion, Italy is the world’s third-largest sovereign debt market after the United States and Japan, and because German and French banks own a sizeable part of Italy’s debt. Reappraisal of the value of Italian debt could affect those banks’ balance sheets and thereby roil international financial markets.

Crashing out of the Euro wouldn’t solve Italy’s problems in the short term, and certainly wouldn’t be likely to encourage bullishness about the prospects of French and German banks. However, unlike was the case in 2012, the German Constitutional Court is now threatening to limit the ECB’s ability to save the Euro.

Hopefully, the German court will realize the stakes involved and will soon back down in its standoff with the ECB. But in the long run, if Italy is to remain in the Euro, Rome will need to fundamentally reform its sclerotic economy to give the country a real chance to grow its way out from under its debt mountain.

Europe’s present threat to the global financial system and to the world trade order would be reduced if the Eurozone were to move soon towards a political and fiscal union. That would allow for the Eurozone’s debt to be mutualized as well as for Europe to adopt a bolder stimulatory budget policy than that at present. Unfortunately for the world economy, Europe shows every sign of not being ready to take that bold step.