Europe Needs to Wake Up and Smell the COVID

While the pandemic has hit Europe particularly hard, economic policymakers on the continent have been slow to respond.

The extraordinary economic challenge posed by the coronavirus epidemic requires an extraordinary economic policy response if the world is to avoid a pronounced and prolonged economic slump. Policymakers in the United States seem to understand this, but the message has yet to cross the Atlantic. Europe’s sluggish response to the epidemic does not bode well for the U.S. and the world economic recoveries once the crisis passes.

In contrast to Europe, before the coronavirus epidemic struck, the U.S. economy was in fine shape. Unemployment was at a fifty-year low, the stock market was at a record high, and U.S. banks had strong balance sheets. Yet as soon as it became clear that the coronavirus epidemic would plunge the economy into a worse recession than that experienced in 2008-2009, U.S. policymakers reacted with unprecedented speed and vigor.

The Fed lost no time in reducing interest rates to their zero bound and committed itself to unlimited Treasury and mortgage-backed-security bond buying as needed. The Trump administration, working with Congress, also came up with a $2 trillion fiscal stimulus package, much of it aimed at helping individuals and small businesses survive until the health crisis has passed.

Unlike the U.S. economy, the European economy was already showing signs of trouble before the epidemic. Three of Europe’s four largest economies – Germany, Italy, and the United Kingdom – were all at the start of recessions. Meanwhile, the European banking system in general and that of Italy in particular had yet to fully recover from the Great Recession. The prospect of a hard Brexit continuing to cloud the European economic outlook did not help.

So far, the coronavirus epidemic has visited the greatest of damage on the U.S. economy. Investment banks like Goldman Sachs and Morgan Stanley are now warning that U.S. GDP is likely to decline by around 25 percent (a new record) at an annualized rate in the second quarter of this year. They are also warning that unemployment will increase by more than 3 million over the next few months.

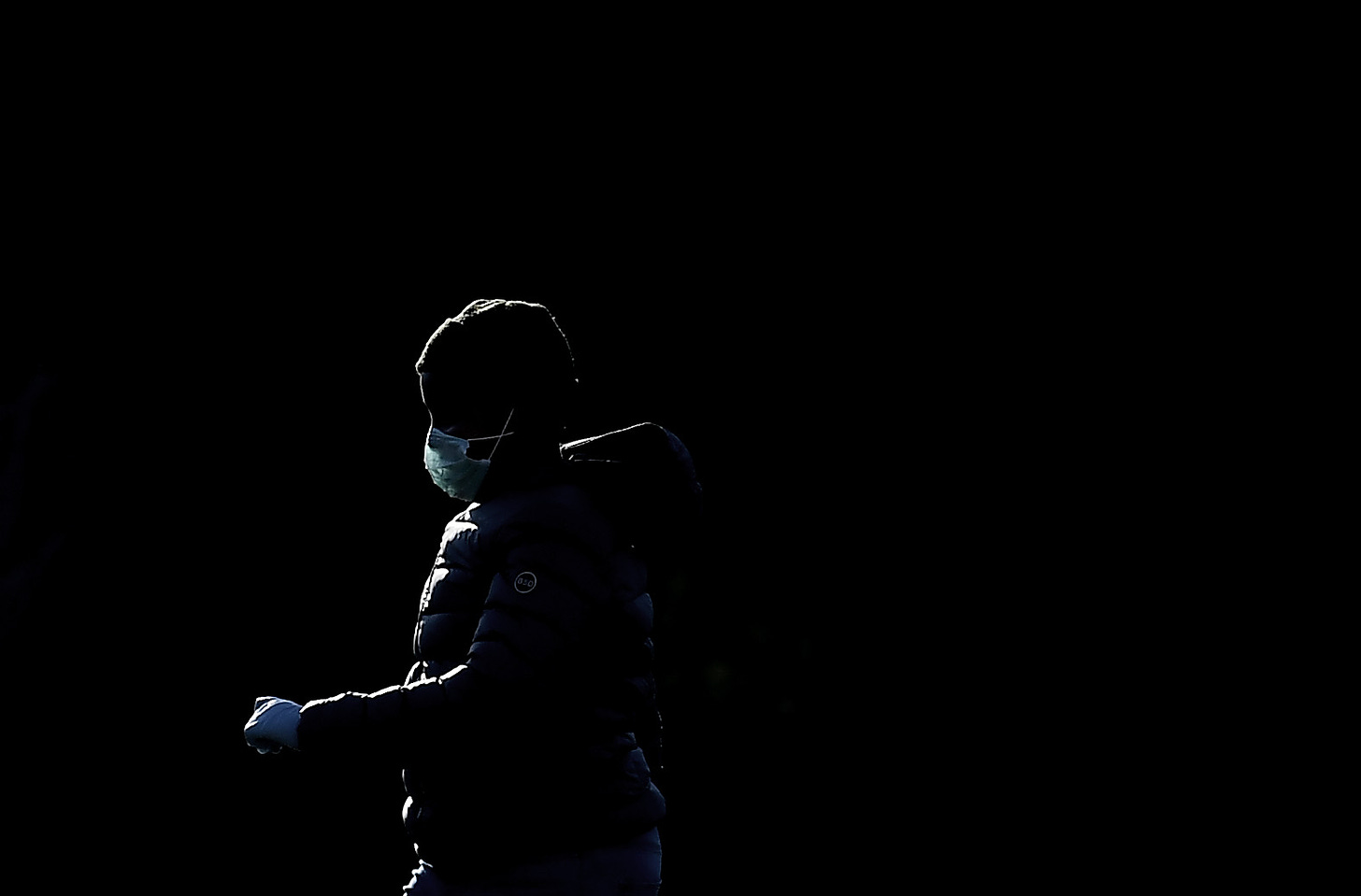

But the damage that the coronavirus epidemic will inflict on the European economy may well surpass the damage to the U.S. economy – especially considering the intensity of the pandemic in Europe, the lockdowns in France, Italy, and Spain, and the sudden stop of entire economic sectors in those countries, such as tourism.

Despite Europe’s considerably bleaker economic outlook than that of the United States, its policymakers have been slower and more timid in their response. Although the European Central Bank (ECB) did increase its bond-buying program by €750 billion, it stopped well short of the Federal Reserve’s pledge of unlimited bond buying as needed. Already stuck with negative interest rates before coronavirus, the ECB couldn’t match the Fed’s interest rate cuts.

While the ECB didn’t have the option of cutting interest rates, EU member states could have pursued vigorous fiscal stimulus, but didn’t. Germany, which had the most room in its budget for fiscal intervention, is only grudgingly considering a €150 billion fiscal stimulus. In relative terms, that would be less than half the U.S. fiscal stimulus package now making its way through Congress. Meanwhile, those countries like Italy and Spain, which are being hit hardest by the epidemic but with limited fiscal space, are taking far less fiscal action than Germany.

Europe’s weak response to its worst economic crisis in the post-war period portends a slow recovery, which would constitute a major drag on the world economic outlook. Worse still, it could be the prelude to a renewed Italian sovereign debt crisis, since it would make it more difficult for Italy to service its public debt. An Italian debt crisis could derail the global economic recovery since it would almost certainly trigger a European banking crisis.

Hopefully, the recent bold U.S. economic policy action will shame the European countries into more effectively confronting the coronavirus’s challenge to the world economy. If not, we should brace ourselves for a slow, anemic, and frustrating global recovery.