Evil or Stupid: How Did FTX Make $8 Billion Disappear?

Also: On the internet, it generally takes a long time for companies to die.

Every week I highlight three newsletters that are worth your time.

If you find value in this project, do something for me: Share this with someone.

Most of what we do in Bulwark+ is only for our members, but this email will always be open to all.

Sign up and get it. You’ll thank me.

1. The Margins

I’ve been waiting for Ranjan Roy to write about the FTX implosion and he did not disappoint:

My hope is that the financial normies reading this get a bit more understanding of the dynamics involved with making markets in an illiquid product that are controlled by a few players who have an informational edge.

And that’s where I get more confused about how SBF lost so much money. The Alameda-FTX connection should’ve done the opposite. FTX could be the exchange promising Insane Financial Product™ and Alameda could make the market on FTX for Insane Financial Product™. Alameda could also be the hedge fund that went directionally long or short Insane Financial Product™. There were so many corrupt ways to make money.

One of the simplest things for Alameda, the directional hedge fund, to do was front-run. They did, in fact, do things like buy up tokens before they were listed on FTX, knowing the price would skyrocket right after. That’s such easy money.

But it’s not just token listings. FTX, the exchange, would have all the data on other market makers and what they were doing and what their orders were. . . .

To have that kind of information should’ve been literal gold for Alameda and FTX. Alameda, the market-maker could run over every other market-maker on FTX. Alameda, the hedge fund, could take directional bets knowing every buy and sell order on the platform. FTX, the exchange, would explode in trading volume.

And then you get into the retail gravy. You have Tom Brady and Gisele convincing the world to jump onto your platform and trade Insane Financial Product™. You’re Robinhood and Citadel at the same time. They could fleece retail. . . .

If all the promise of machine learning whizbangery was true, the FTX-Alameda corruption was set up to be a magical money machine. The markets they were playing were being invented in near real-time without any regulation, they controlled all the levers for how those markets should move, and they were theoretically doing it at scale with unimaginable speed and precision. That’s what keeps making it more confusing how they ended up losing so much money.

Read the whole thing and subscribe. It’s totally worth it because (a) they publish infrequently and (b) it’s free. And (c) they manage to work in lines like this while talking about finance: “I ended up long a bunch of Dong.”

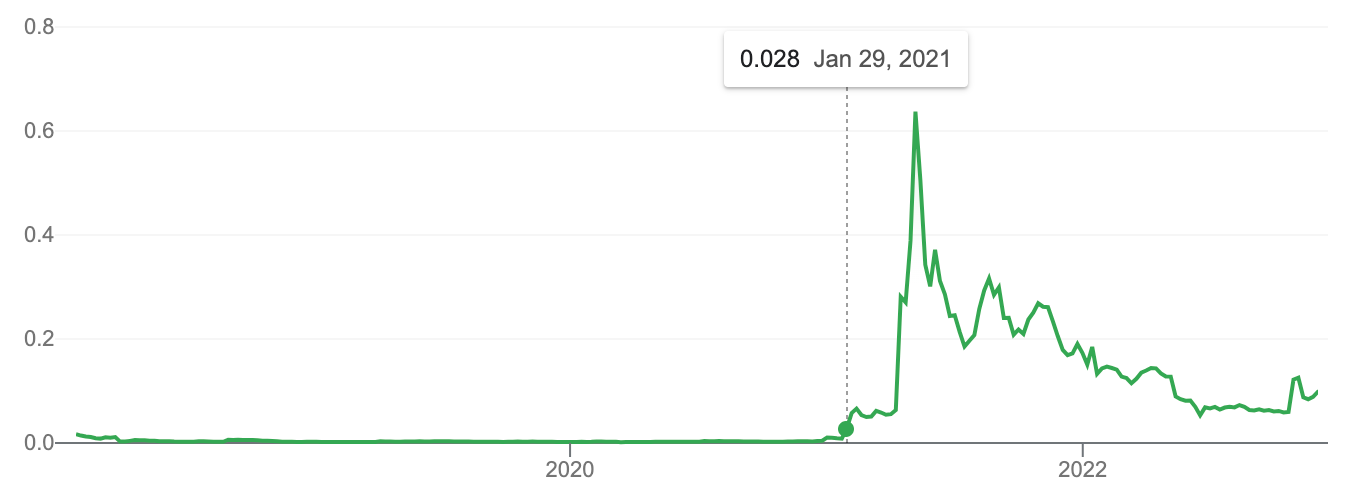

Ranjan is interested in just how FTX was able to lose so much money. Part of the answer seems to be that the FTX “magical money machine” was just some nerds sitting around the office and deciding, “Fuck it, let’s go long on dogecoin. 💎 🙌 🚀 and be legends!”

Being long DOGE was a sweet position in early 2021. But not so much anymore.

Anyway, we have two large outstanding questions about FTX.

Where did the money go?

Why did this happen?

Was it some sort of Madoff-like criminal masterplan?

Or was it the stupidest self-own in the history of modern finance?

Based on the available evidence, I’m leaning toward (b). This is what happens when a bunch of clever, overindulged kids are given billions of dollars in a totally unregulated environment while the world is on a decade-long ZIRP bender.

2. History Boomer

Yes, I’m sorry, we have to talk about Twitter, too.

History Boomer has noticed that despite the mass panic, Twitter has not ceased to exist:

Progressives had already declared that the bird app was dead and Elon Musk had killed it, and yet here it was, fluttering along, continuing to send out its relentless stream of inanity, insanity, and incongruity (with just enough substance and amusement to keep us all hooked). How dare Musk and Twitter keep going when the progressive left had assured each other that his business was going down like the Titanic? (And made the Titanic memes to prove it.)

How? Because Twitter didn’t care about their politics. It didn’t and doesn’t care about anyone’s politics. It’s a business not a thermometer of righteousness.

The assumption had been (and continues to be) that Musk was screwing up everything by introducing horrible new ideas (blue checks ✔️ for everyone!), alienating advertisers (Eli Lilly’s stock dropped after a parody Eli Lilly impersonator account tweeted “we are excited to announce insulin is free now”), and firing staff higgledy-piggledy (although at least Musk hired back the famous Ligma and Johnson). . . .

I’m making fun of progressive Musk haters because I think their confidence in Twitter’s demise is funnier but those on the right are being pretty silly too. Every day I see them laying out their 18-tweet threads explaining how Musk is playing 7D chess and will soon be raking in hundreds of billions from his brilliant Twitter strategy. Yeah, sure.

What’s really going to happen with Twitter? I don’t know.

Here are some dead media companies you may have heard of: AOL, Yahoo, MySpace. We all remember when they were world-bestriding giants and now, ha-ha, they’re roadkill.

Except that all three of these companies are still currently operating. They’re much diminished. They’re husks, for the most part. But the websites are still operational. It takes a looong time for an internet business to go ka-blewy. Hell, GeoCities—GeoCities!—only closed up shop three years ago.

I tend to think that Musk will destroy Twitter—but destroy it in the way that Facebook destroyed Friendster: Spark a long period of inexorable decline during which relevance dissipates quickly as the business dies slowly.

Even if something spectacular happens to Twitter, like a bankruptcy, the platform will keep chugging long after it has ceased to serve any meaningful public function.

3. Don’t Worry About the Vase

You say you want MOAR FTX?

Fine. Let me hit you with Zvi Mowshowitz because he brings the receipts on Caroline Ellison, who was Scarlet to SBF’s Snake-Eyes:

Caroline Ellison was the CEO of Alameda Research, and has admitted knowing that SBF stole customer funds to give to Alameda.

She also wrote a bunch of very frank things on the internet.

One source described it as, ‘that feeling when Caroline is based as hell but also evil and steals your money.’

Here is Caroline on flipping coins for high stakes.

Caroline wrote a Goodreads review of Barbarians at the Gate (as opposed to SBF, who says he never reads books and Your Book Should Have Been a Blog Post). It said:

The source called it a good summary. I have not read the book but I think this is exactly wrong, in that what happens after the ??? step is that shareholder value is not maximized. The CEO and board do what is good for them, which may or may not involve shareholder value, and mostly the parasitic managerial class does its thing. The whole point of Barbarians at the Gate, as I understand it, is that the ‘barbarians’ notice that shareholder value is not being maximized and thus propose to buy the company.

Read the whole thing. It’s a vaguely a Hunter S. Thompson-ish ride.

If you find this newsletter valuable, please hit the like button and share it with a friend. And if you want to get the Newsletter of Newsletters every week, sign up below. It’s free.

But if you’d like to get everything from Bulwark+ and be part of the conversation, too, you can do the paid version.

That's my best guess for Twitter as well. Turning it into a zoo drives away advertisers and consumers while lack of internal security allows bots to proliferate and eventually it dwindles down to Parler-plus status.

It's already losing space in the headlines as The Stupid Thing Elon Said Today gets less and less shock value.

Strangely enough, most people have an aversion to hanging around open sewers. At least the Dorsey regime would do some desultory sprays of air freshener to make it a less repulsive sewer, but the most of people are going on with their lives.

I have mixed feelings on the Crypto crash. On the one hand it was so obviously a scam from the word go I am amazed that anyone could be dumb enough to put their money in it.

On the other hand scammers take in honest people all the time. Unfortunately, the biggest losers seem to be people of modest means who could least afford to lose their money.

Time tested advice is often right:

1 - Never invest in anything you do not understand.

2- If it sounds too good to be true....