Every week I highlight three newsletters that are worth your time.

If you find value in this project, do two things for me: (1) Hit the Like button, and (2) Share this with someone.

Most of what we do in Bulwark+ is only for our members, but this email will always be open to everyone.

That said, we’re running an $8 Blue-Check Special, which is something we’ve never done before and probably won’t do again. Promo Code is:

1. Hardcore Twitter

How does it differ from softcore Twitter? No close-ups? More dialogue?

Look: I did not intend for the Saturday Triad to become the Special Twitter Death Watch, but here we are.

Casey Newton continued his excellent reporting last week with a dispatch about Elon’s ultimatum that Twitter’s remaining employees name five brands of cereal while being punched by Marc Andreeson pledge to go “extremely hardcore” at the office.1

So: In case you’re keeping score: First, Musk fired 50 percent of Twitter’s salaried workforce. Then he fired 80 percent of the company’s outside contractors. And his “hardcore” edict now seems to have convinced several hundred more full-time employees to nope the eff out of Dodge.

That’s just management chaos. Musk’s strategic vision for the company doesn’t look so hot, either. Here’s Newton:

So what will remaining Twitter employees be working on?

A seating chart obtained by Platformer for the 10th floor of Twitter headquarters in San Francisco offers some clues.

Employees working on special projects and the product team have been assigned to the 10th floor, according to the document. It lists five project teams:

Blue verified, the $8-a-month verification badge that is scheduled to relaunch Nov. 29 after a disastrous debut last week.

Blue for business, a new enterprise verification offering.

Encrypted direct messages.

“Tips on tweets,” a possible expansion of a feature that lets users send one another tips through their profiles.

“Longform notes,” an apparent replacement for a feature that launched in June but that Musk cut soon after taking over.

That’s it?

The company-saving roadmap consists of:

Re-introducing the feature that already nuked the advertising business.

Creating an enterprise version of this same feature—not understanding that businesses will face the same reputation risk that advertisers do.

A What’sApp competitor.

Letting people DM through their profiles instead of their messages.

Re-doing a feature Musk killed a couple weeks ago.

That’s the plan.

Good luck with your $13B write-down, my man.

Listen: I recommend all of the newsletters I share with you guys, but on this one, I can’t stress it enough: If you want the best reporting out there on the Twitter saga, Casey Newton’s Platformer is a must-read.

One more thing: Late on Friday Musk issued a new “policy.”

There are some logistical questions, of course. What it is the difference between “negativity” and “hate”? What are the standards by which tweets will be judged? How will these decisions be made? Will users be able to tell if a tweet has been max deboosted?

Also: Which employees will be tasked with this job? Seems like it will require a lot of man-hours.

But what makes this chef’s kiss is that the policy Musk describes is identical to a phenomenon known as “shadow-banning.” And shadow-banning was one of the principle grievances that Musk and his New Right cronies had against the previous Twitter regime.

For Musk, like so many others, everything—and I mean everything—is simply a version of Who, whom?

2. At Least Twitter Isn’t FTX

As bad as things are at Twitter, it’s no FTX. Matt Levine has the best coverage of the FTX bankruptcy and this week he went through the filing put together by new FTX CEO John J. Ray III.

John J. Ray III is an executive who specializes in managing high-profile corporate bankruptcies and here’s what he says in his initial declaration for the FTX filing:

Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here.

That sounds very bad.

It sounds even worse once you know that John J. Ray III was the guy who managed the Enron debacle.

So: FTX = way worse than Enron.

Yikes.

Here’s Levine:

In seeking rescue financing, Bankman-Fried circulated a rough balance sheet showing about $9 billion of customer deposits. Against that $9 billion of deposits, FTX’s liquidators have found about $740 million of cryptocurrency, not counting the hundreds of millions of dollars of cryptocurrency that were drained from FTX’s poorly secured wallets when it filed for bankruptcy. They have also found about $564 million in cash, though, “because of historical cash management failures, the Debtors do not yet know the exact amount of cash that the FTX Group held as of the Petition Date.” There’s some crypto, there’s some cash, nobody quite knows how much, but it’s pretty clear that the basic answer is “not nearly enough.”

Also: In the bankruptcy filing, John J. Ray III makes it clear that, if you believe the FTX books, then the people who ran the company had no idea what and/or where their assets were because they did not keep track of them.

Like, literally. Did not write them down.

More Levine:

Imagine being the new CEO of a giant investing firm, and coming in to work your first day and asking your employees: “So, what investments have we invested in?” And they answer: “I don’t know, why don’t you Google it, maybe there are some newspaper articles about the investments we made.” “Reviewing various third-party sources to locate investments”! FTX/Alameda made investments and didn’t write them down, but maybe somebody else kept track of what they own. What.

But all this stuff about FTX barely keeping track of its assets is somehow less bad than the stuff about FTX not keeping track of its liabilities at all. As part of his declaration, Ray presents unaudited September balance sheets of each of the FTX silos, though he presents them mostly for entertainment purposes . . .

I have a lot to say about this and the first thing is that Matt Levine writes this stuff and gives it away for free every day. If you’re not subscribed to his newsletter, you’re missing out. So go subscribe to him.

Another thing is that if you grab someone’s purse and run away with it and get caught, you will probably go to jail. If you break into someone’s home and steal a computer and get caught, you will probably go to jail.

If you “lose” a few billion dollars of other people’s money, then it is an open question as to whether or not you face any legal consequences. Adam Neumann didn’t. Some of the Enron executives did short time—only to emerge from prison to hit the lecture circuit.

By a funny coincidence, on Friday Elizabeth Holmes—the Theranos fraudster—was sentenced to 11 years in jail.

We’ll see how much time she serves.

Steal a thousand dollars and you’re a criminal. Steal a few billion dollars and maybe you’re a criminal. Or maybe you’re just a visionary who flew too close to the sun.

3. Parody

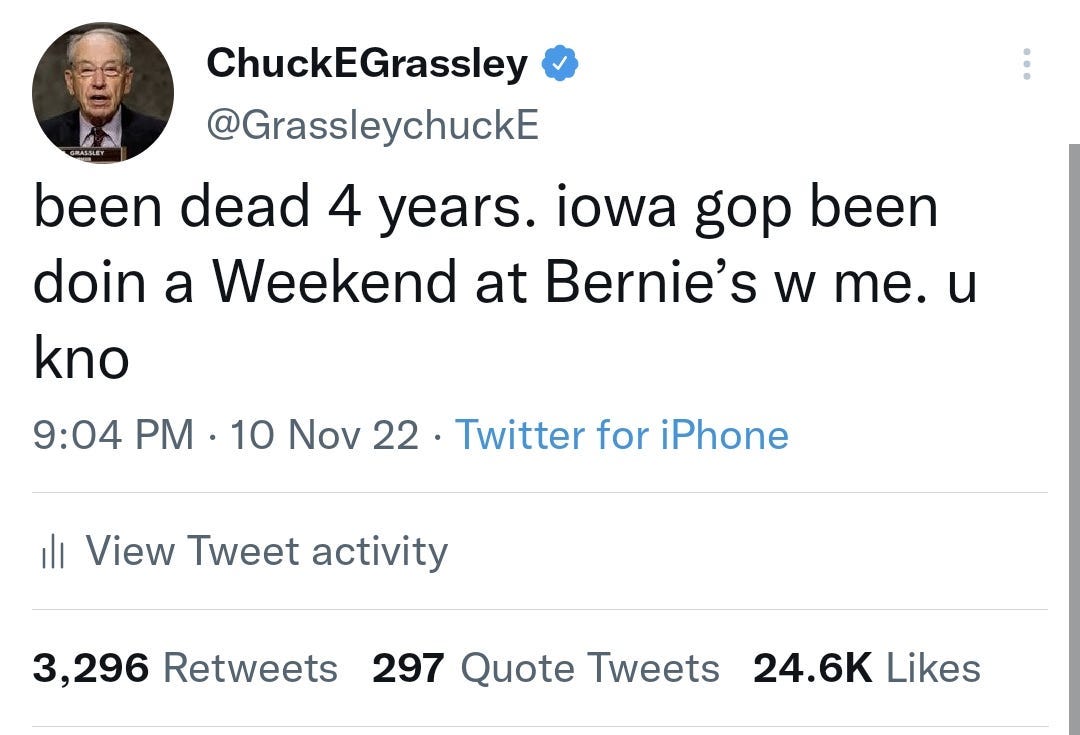

Lyz Lenz made a parody account. Hijinx ensued:

I own precisely one Apple product — my 11-year-old daughter’s iPhone. So, I grabbed it and purchased a Twitter Blue and created an account mocking my senator Chuck Grassley, who had just been re-elected at 89 to serve his seventh term as senator. . . .

I’d spent the better part of seven months researching Grassley for a profile. I’d studied his tweets and read countless news stories about him. I’d gone to his hometown and talked to his childhood friend, brother-in-law, and family friends, who didn’t want to be quoted. I felt like I’d gotten very adept at understanding him. And I could tell when his characteristically erratically typed tweets were real or from his staff emulating him.

$8.17 (that includes tax) poorer, I joined in the melee.

Eleven hours later, at least one of the tweets had gone viral. And 11 hours later, after the tweet and many others using Twitter Blue to lampoon politicians and companies had gone viral, Elon Musk announced the end of the program. He plans to relaunch it again. After some tweaks.

Read the whole thing and subscribe.

If you find this newsletter valuable, please hit the like button and share it with a friend. And if you want to get the Newsletter of Newsletters every week, sign up below. It’s free.

But if you’d like to get everything from Bulwark+ and be part of the conversation, too, you can do the paid version.

Certain conservative rubes applauded this dictum, apparently believing that the staff at TwitterDotCom are a bunch of pampered layabouts who spend all day playing minesweeper instead of tending to their TPS reports. This view is only really possible if you have zero experience with tech world. Because say what you will about the civilization-destroying effects of social media: The people who run these doomsday machines put in plenty of hours.

Re your footnote: "Certain conservative rubes applauded this dictum, apparently believing that the staff at TwitterDotCom are a bunch of pampered layabouts who spend all day playing minesweeper instead of tending to their TPS reports. This view is only really possible if you have zero experience with tech world. Because say what you will about the civilization-destroying effects of social media: The people who run these doomsday machines put in plenty of hours."

The same "certain conservative rubes" firmly believe civil service employees -- particularly those they deem 'deep state' -- are pampered layabouts who spend their time playing solitaire and checking porn sites on government computers while occasionally stopping to text about overthrowing God's deputy on earth.

And yet, the pampered layabouts find time to do their jobs serving and actually protecting Americans of all stripes (even certain conservative rubes), who always seem surprised by the layabouts' successes and their own cock-ups.

Most curious.

Most of the human race who aren't journalists, OSINTers, or citizens living under authoritarian governments need to get the hell off of social media, so I rejoice after every social media site comes apart. I hope that TikTok is next. The shit this stuff is doing to our brains--especially the brains of young people--is making this technology more harmful than helpful. Go check Jonathan Haidt's research on social media and what it's doing to our brains and tell me this stuff should stick around:

https://jonathanhaidt.com/social-media/