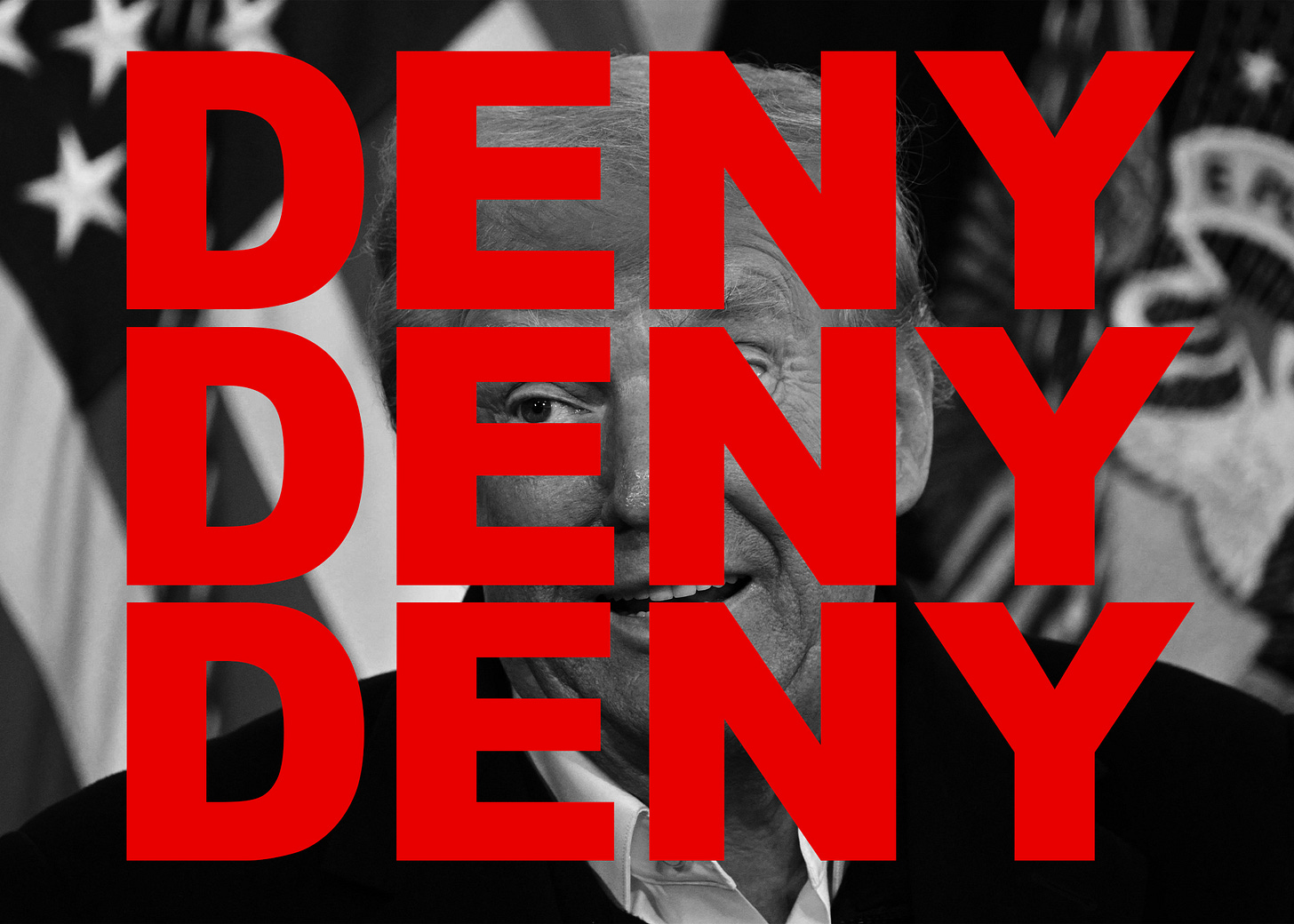

The Party of ‘Denihilism’

Republicans are rejecting reality while embracing destruction—just look at the House budget megabill.

THE HOUSE REPUBLICANS’ “One Big Beautiful Bill” is big, at over a thousand pages. But is it beautiful? Not in the eyes of this beholder.

All I can see when I look at it is “denihilism,” a word my former boss at USA Today, Bill Sternberg, used this week in an article about climate change, the coming hurricane season, and the many ways the Trump administration has weakened and destabilized federal weather forecasting and disaster response agencies.

These actions, Bill wrote,

appear driven by a combination of scientific denial (if you pretend a problem like climate change doesn’t exist, then you don’t have to do anything about it, particularly anything that would offend fossil fuel interests) and ideological nihilism (taking a perverse pleasure in inflicting trauma on federal employees and watching the world burn). Call it denihilism.

The gigantic House budget bill that passed by one vote is denihilism to the max. On climate alone, it would roll back Biden-era clean energy incentives and programs, resulting in over 800,000 lost jobs, increased climate-warming pollution, and rising electricity prices—a triple threat to workers, public health, and the cost of living. Not to mention setbacks to U.S. progress in clean-energy manufacturing.

The 215–214 vote came hours after a stock selloff sparked by analyses showing the bill’s tax component—extending, expanding, and reviving provisions of the 2017 tax law—would increase U.S. debt by $3 trillion to $5 trillion over ten years, with interest costs approaching one-third of all federal revenues, amid downgrades of U.S. creditworthiness.

While most of the tax benefits go to upper-income households, most of the savings proposed to offset about a third of the tax-revenue losses would penalize lower-income Americans by cutting roughly $1.1 trillion in health coverage and food benefits. And they would be cut in a deceptive way—by increasing red tape and paperwork to the point where stressed, needy, busy people just give up.

The GOP plan, public policy professors Pamela Herd and Donald Moynihan wrote this week, relies on “opaque cuts, which will shed millions of eligible beneficiaries by overwhelming them with pointless paperwork and other needlessly complicated administrative requirements.” They are less obvious than outright cuts, but they’ll have the same effect—making it “impossible for eligible clients to access the safety net.”

Republicans aren’t stopping at adding work requirements and administrative burdens to Medicaid, the health insurance program (no cash handouts) that’s a lifeline to hospitals and over 70 million low-income people, almost all of whom are kids, parents, disabled, or already working. They’re also reversing years of reforms to ease enrollment and renewals—“simplifying applications, eliminating confusing paperwork and automating processes,” Herd and Moynihan note.

THE GOP BILL TAKES THE SAME APPROACH to the Supplemental Nutrition Assistance Program (SNAP), known as food stamps, that 40 million children, seniors, and disabled adults count on. Republicans are counting on the burden of work requirements to pare participation and costs, and on states to find money to pay an increased share of the joint federal-state program.

The knock-on effects of all of this can hardly be overstated. There’s solid evidence that these kinds of complexity can stunt and wreck lives, a concept I wrote about in connection with the fiftieth anniversary of the War on Poverty in 2014:

In Scarcity: Why Having Too Little Means So Much, economist Sendhil Mullainathan of Harvard and psychologist Eldar Shafir of Princeton show that simply feeling poor makes it very hard to think clearly. Their studies found the same dramatic results whether the subjects were Indian sugarcane farmers or shoppers at a New Jersey mall. Feeling rich (the farmers who were studied after their harvests, for instance) resulted in good performance on intelligence tests. Feeling poor produced much worse results.

Worries about not having enough money, it turns out, can subtract 13 IQ points from your mental capacity or “bandwidth,” as the authors call it. That’s a more profound effect than losing a full night’s sleep.

The upside of the research is that the scarcity-perpetuating-scarcity problem can be fixed. “Starting from the premise that programs for people in need should use as little mental bandwidth as possible, the potential for policy remedies is clear,” I wrote. For instance, for people eligible for multiple programs, a one-stop shop open for long hours would relieve stress by reducing time spent on public transportation, in waiting rooms, and away from jobs.

Unfortunately for us, we now have a Republican party determined to make policy remedies as complicated as possible, knowing and perhaps even intending that the result will be more scarcity. How can that possibly help the country?

The GOP safety-net plans, not surprisingly, are wildly unpopular. Data for Progress, a progressive polling firm, found overwhelming opposition to SNAP cuts in every single congressional district in the country. Less than 15 percent of likely voters in each district support the cuts, the firm said Thursday.

It’s true that some parts of the GOP megabill enjoy broad support. Eliminating federal income taxes on tips and overtime, in line with Donald Trump’s campaign promises, is in the bill, at least for now. The exemption only lasts through 2028, and it could disrupt the labor market, and safety-net cuts could cancel out any advantage to families, but it’s one of the only appealing talking points available to Republicans. If they end up keeping it.

As for Democrats, those safety-net cuts are a political layup. Senate Republicans might prevent the worst, but 215 House Republicans are already on record as voting for it. And, as the fictional detective Harry Bosch’s mantra goes, “Everybody counts or nobody counts.”

He’s talking about bringing justice in equal measure in all his cases. We should be making sure all Americans have the opportunity to live their best lives, instead of making sure we shower the most generous tax cuts on people who need them least.