1. Absolutely Not Market Manipulation

Capitalism is awesome. A few weeks ago Elon Musk bought a bunch of Twitter shares. Then he told people that he bought Twitter shares. And the stock price of Twitter went up, because one of the immutable laws of economics is that the closer a good is to Elon Musk, the more valuable it is.1

You know what happened next: Musk was invited to join Twitter’s board. Then he backed out. Then he tweeted a bunch of stuff about Twitter. Then he deleted those tweets. Then he made a public offer to buy all of Twitter for $54.20 a share.

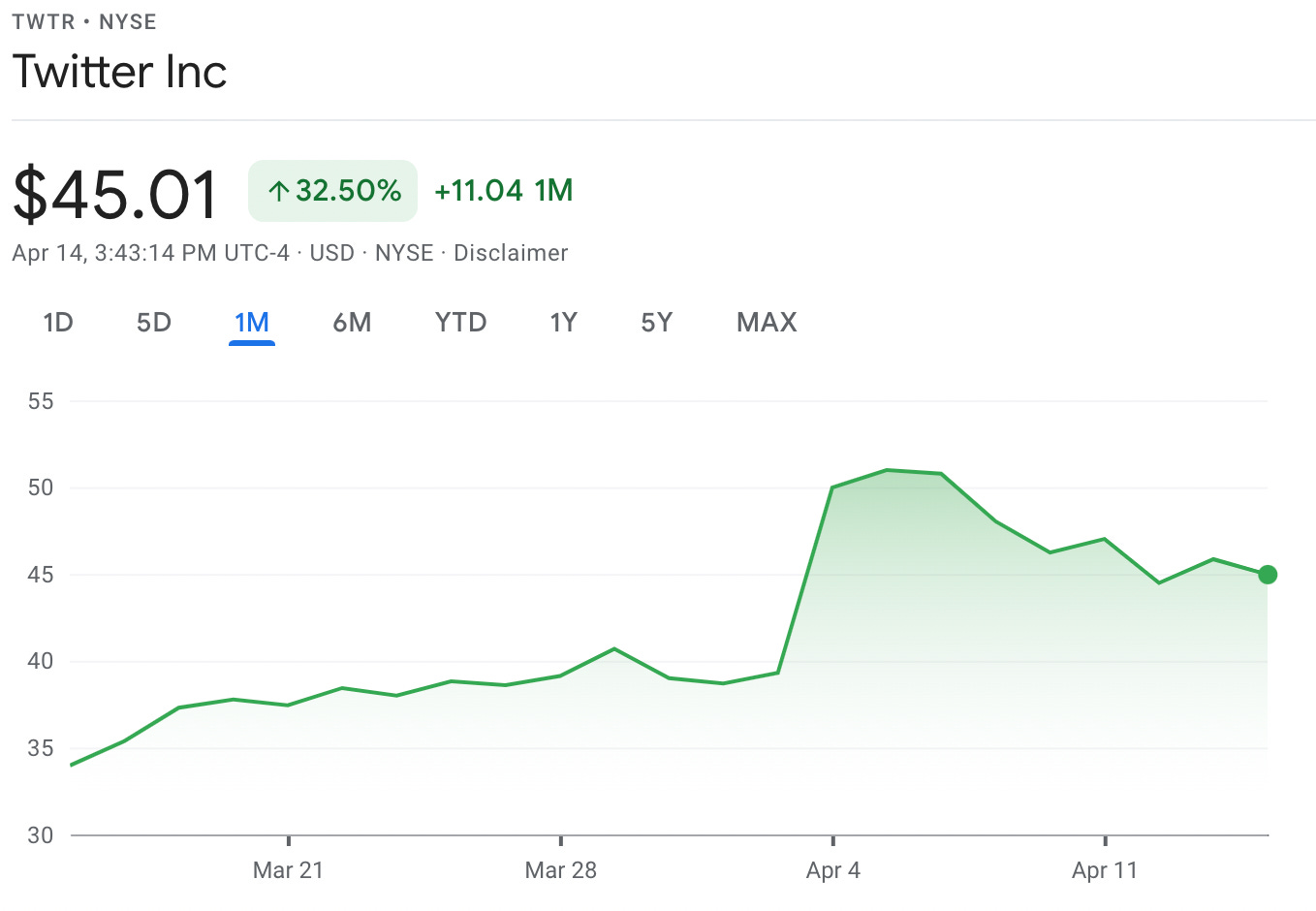

But, like, is Musk serious about taking over Twitter? Obviously, the market doesn’t think so. Twitter stock shot up when Musk announced he’d bought 9.1 percent of the company. When Musk announced that he wanted to buy 100 percent of the company it . . . stayed flat and then tailed down a bit.

Now, William Cohan is very smart and he thinks Musk is serious:

The most important question is not whether the Twitter shareholders will love the price Musk is offering; it’s whether the $54.20 price is “fair,” from a financial point of view. . . . If the answer is yes—and I believe it is, or soon will be—then the board will have little choice but to accept Musk’s offer, or try to negotiate him up from $54.20, despite his promise of skipping straight to the end. If the answer is no, Musk’s offer is not fair, then he can take his hostile offer directly to Twitter’s shareholders by making a tender offer for their shares. This could make the board irrelevant, but more likely would just put more pressure on the board to reach a deal.

If, say, another 42 percent of Twitter shareholders tender their stock to Elon, giving him a 51 percent ownership position, are we really to believe that the Twitter board will still give him the stiff arm? Not a chance. He’s well advised by Morgan Stanley. This is not a joke, or a drill. This is for real. If somehow, the board says no, or Musk withdraws the offer, and sells his stake, the Twitter stock will fall into the low-to-mid 30s. Then the Twitter board will really have hell to pay, when they face a plethora of shareholder lawsuits. . . .

The decision has already been made for Twitter, too, I believe. It is toast. The job for the Twitter board will be to do whatever it can do—which isn’t much—to make the best deal with Musk that it possibly can. And it will do that. And Twitter will be sold to Elon Musk. That’s the way the world works. His price is fair and there will be no higher bidder.

This is very compelling . . . but part of me rebels against it.

For instance: Market-based logic tells us that $54.20 a share is a right price for buying Twitter outright because no one else is offering $54.21.

On the other hand, if $54.20 is a fair price, then why are Twitter shares sitting at $45.08 as of this writing? So the market is telling us one of two things: Either (1) Musk is offering a lot more than the stock is worth; or (2) Musk isn’t actually going to buy $40b worth of Twitter.

Musk’s entire business case is that Twitter’s big problem is the platform’s restrictions on “free speech.”

I suppose you could make a philosophical case for Twitter bringing the Gab and Gettr and Parler (and Truth) users back onto the platform for a full orgy of FREE SPEECH. But a business case? Is having more racists, Nazis, anti-vaxxers, and Sonic fetishists going to make Twitter a better platform for the average user and thus bring in more ad revenue?

I kind of doubt it.

In fact, if you were going to make a list of things that suck about Twitter’s U/X, “not enough psychotic a-hole users” would probably be pretty far down. I mean: You have been on Twitter, right?

And also: The market has created so many alternatives! If absolute, unfettered freedom of expression was so valuable, then Gettr and Gab and Parler would be worth a lot of money. They aren’t.

So is Musk really going to buy Twitter?

I doubt it. His most liquid asset is Tesla stock and he’d have to unload more than $40b of it. That’s not super easy. (It’s also not good for Tesla.) Failing that he’d have to pull together financing. Who on earth wants to be in the Twitter business?

So what gives?

Oh, who can say. But just for fun, remember the time Tesla quietly bought a billi of bitcoin and then announced that it would accept bitcoin as payment for cars, which is totally a non sequitur except that said announcement caused the price of bitcoin to jump?

Or, remember the time Musk said he had secured funding to take Tesla private at $420 a share? (Remember that number.)

Or, remember the time Musk tweeted that he thought Tesla shares were overvalued?

Or, remember all the times Musk flipped off the SEC?

Or, all of the dogecoin stuff.

It’s almost like this is a guy who’s reached the point in life where he can’t get it up except by manipulating markets as part of a weird D/s relationship with the Securities and Exchange Commission.

It’s his kink.

So what’s the Musk end game for Twitter? My buddy Travis suggests that the roadmap was always going to be the following:

1. He quietly purchases 9% of the company (and under-discloses how much he purchased to cheat SEC regs).

2. He knows when the news breaks on this, the stock price will jump.

3. He’ll then parlay this into a seat on the board and Twitter will agree to prevent a hostile takeover.

4. When they hand him the legal documents to join the board, the board and his lawyers are like “Um, you know you have to legally act as a fiduciary on behalf of Twitter if you’re on the board. You can’t badmouth them or try to fuck them up.”

5. Must then decides he doesn't "want" to join the board.

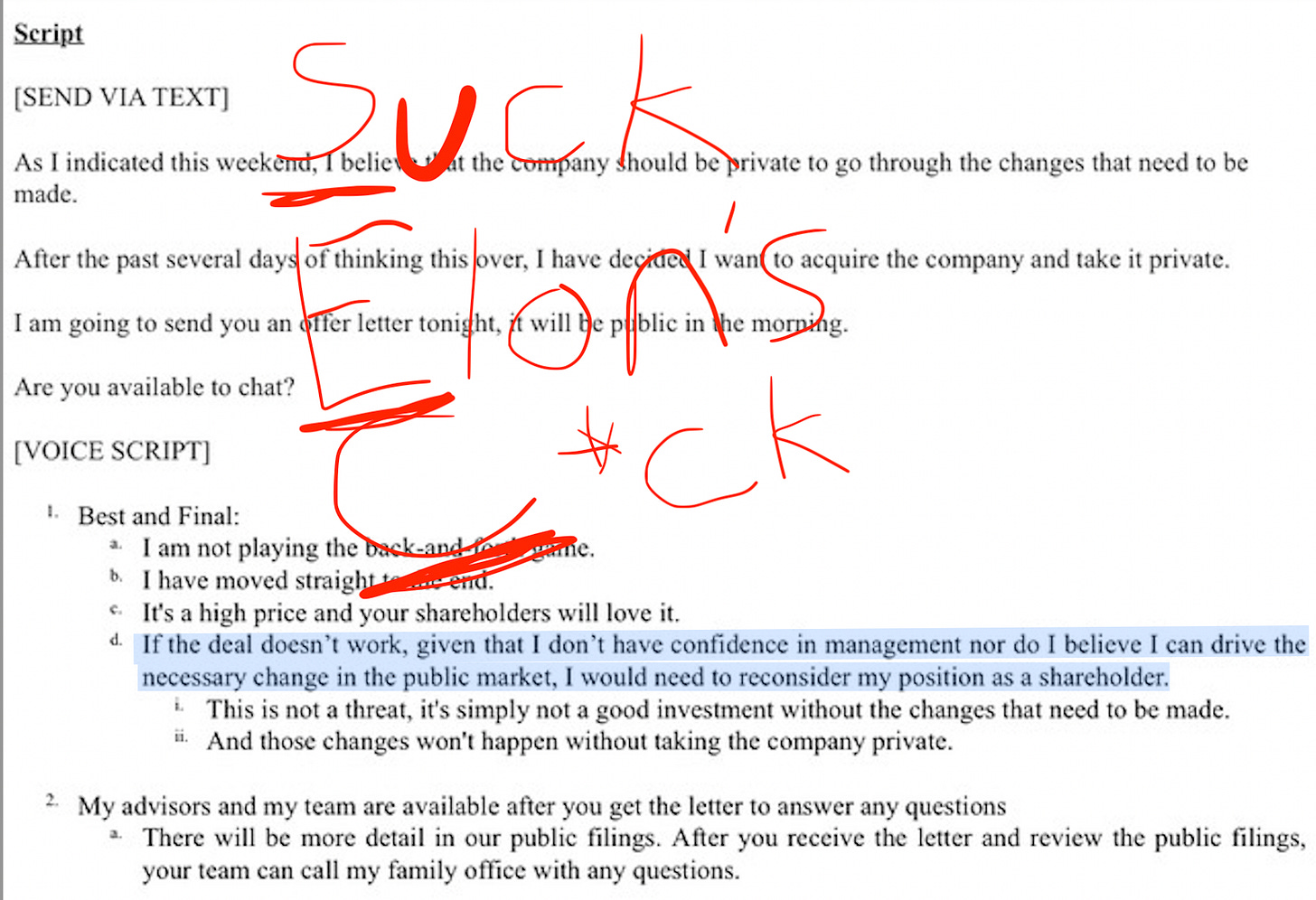

6. He writes a letter to Twitter Chairman Bret Taylor saying he wants to buy the company for $54.20 per share in cash, and ensuring it gets leaked.

My prediction for what’s next:

Within the next few days or weeks, he will blame the Twitter board for not selling to him and then dump his shares. Maybe he has a large options position on the stock jumping as well. I bet he’ll short or hold a large put position when he announces he’s not buying.

He will dump his shares when he announces he’s not buying?

Oh wait—he already told us that if Twitter doesn’t sell, he’s going to dump.

Obviously, that SEC joke was not in the filing. I added it to be funny. But it’s not my joke. It’s a joke Musk made on Twitter’s Puritanical pro-censorship platform a couple years ago.

Would Musk tell everyone he’s dumping before he does it? Would it be illegal if he didn’t? I don’t know! I’m not a lawyer! None of this is either legal or investment advice.