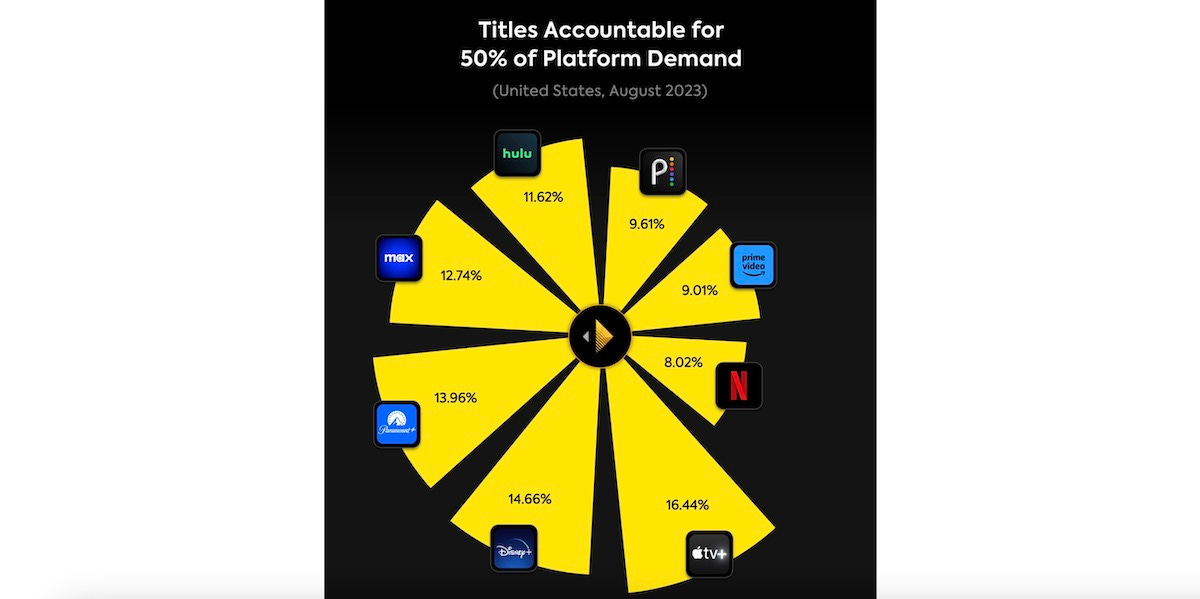

This week, I’m joined by Brandon Katz to talk about Parrot Analytics’s new report on the state of streaming and why the “winner take all” theory of the so-called streaming wars was always a little bit silly. We discuss what attracts viewers to the streaming services, what keeps them there once they sign up, and how Parrot Analytics measures “demand” for a show. If you love charts and data visualization, you’ll love Parrot’s new report; I highly recommend checking it out if that’s your cup of tea. And if you enjoyed this episode, I hope you’ll share it with a friend!

Share this post

What's Next in 'The Streaming Wars'

www.thebulwark.com

What's Next in 'The Streaming Wars'

Parrot Analytics's Brandon Katz on the path to multiple victors in streaming.

Jan 06, 2024

Bulwark Goes to Hollywood

Audio

Sonny Bunch on movies, technology, and understanding the next Hollywood

Sonny Bunch on movies, technology, and understanding the next HollywoodListen on

Substack App

RSS Feed

Recent Episodes

What's Next in 'The Streaming Wars'